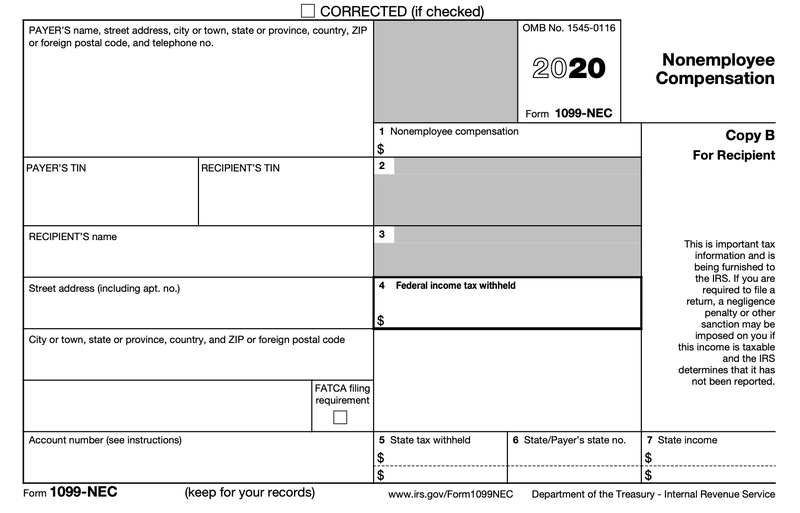

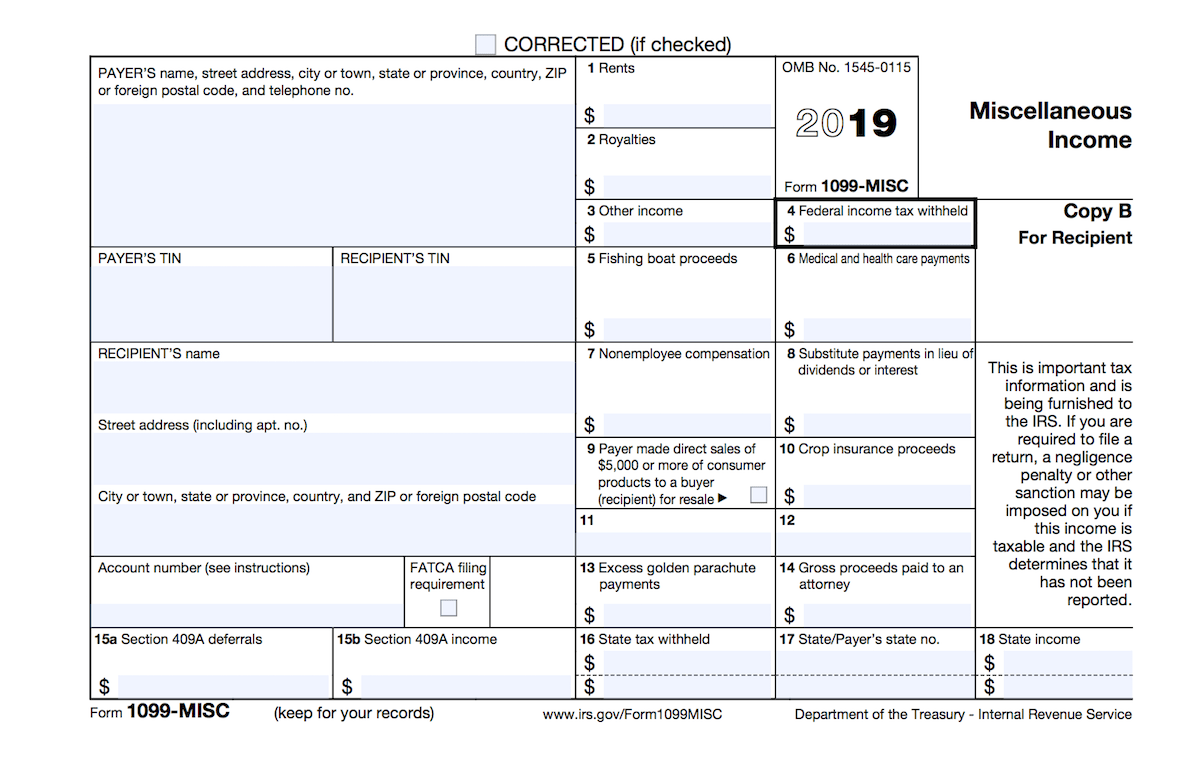

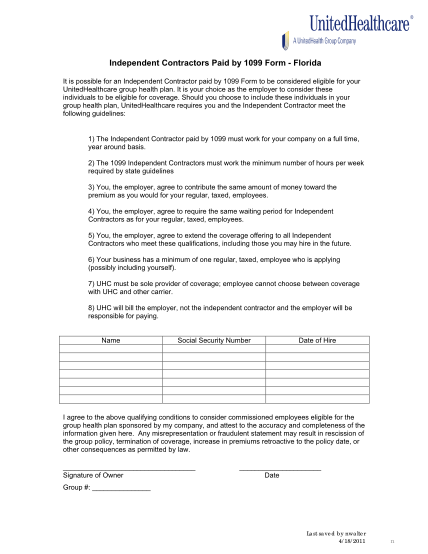

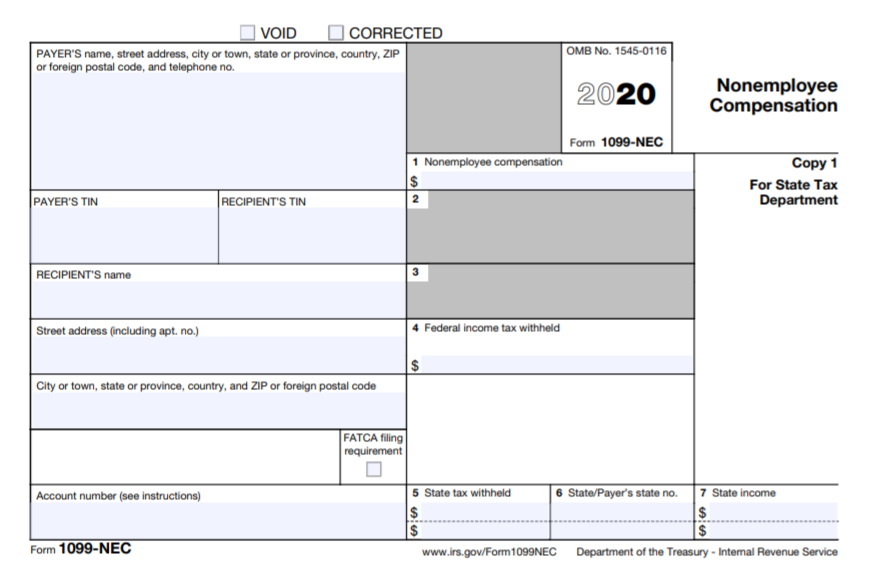

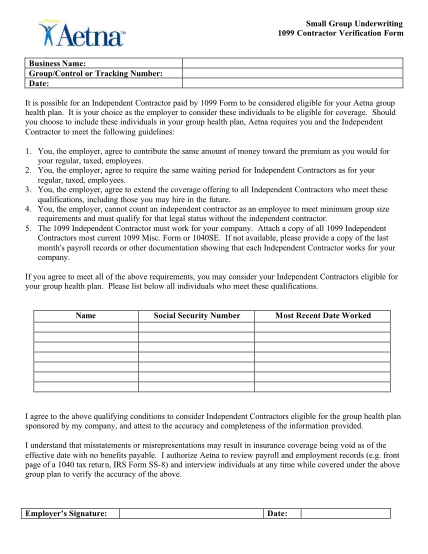

If an independent contractor earns more than $599 from a singlepayer, that payer is required to issue the contractor a 1099 form detailing their earnings for the year16/3/21 Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC)1099 independent contractors are selfemployed freelancers and usually receive payments according to the terms of a contract They report income on their tax return with the IRS by getting a 1099 misc tax form Let's dive deeper into what distinguishes 1099 contractors and

How To Approach Tax Season As A 1099 Employee Thepaystubs

1099 independent contractor laws

1099 independent contractor laws-They waive any rights as an employee Independent Contractor Defined People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors However, whether these

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips (for which Form W2 is used instead) The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds Many companies choose to hire employees as independent contractors for many different reasons Employees as independent contractors can pose major complications for H1B sponsorship Before approving an H1b petition, USCIS must be satisfied that a valid employeremployee relationship exists between the petitioner and the beneficiaryInstead he is an independent contractor, or consultant, who is considered to be selfemployed Like most selfemployed workers, they do not typically receive employee benefits, such as health insurance or retirement benefits, but they may have more flexible work schedules and locations

2/6/21 President Biden's budget tackles 1099 independent contractor misclassifications President Joe Biden's 22 budget plan released Friday highlighted his administration's commitment to employment protection to workers who have been classified as 1099 independent contractors The budget calls for the US Labor Department receiving $754/3/21 Form 1099NEC Introduced by the IRS in , the Form 1099NEC is for reporting independent contractor income – officially termed "nonemployee compensation" It's a new way to report selfemployment income, taking place of what you would typically report in box 7 of Form 109923/2/18 Independent contractors are different from those that are selfemployed in that the gym owner collects client fees and then pays you vs you collect client fees and then paying them In many ways being a 1099 independent contractor is more like being selfemployed and less like being an employee because of the responsibility and independence

Easy 1Click Apply (SUPERIOR FREIGHT LOGISTICS INC) 1099 Independent Contractor/Courier Delivery Driver job in Atlanta, GA View job description,1099 Independent Contractor Compliance Would Your Company Benefit From an Independent Contractor Evaluation Program?Dropoff, Inc, a premier same day medical delivery service, currently seeking 1099 Independent contractors to join our team as a Medical Couriers based around Charlotte, NC Deliveries are local and regional, that are set up on a day to day basis We offer a competitive environment whereas the more you work, the more you will make

1099 Form Independent Contractor Lance Casey Associates

My Employer Says I M An Independent Contractor Does L I Cover Me

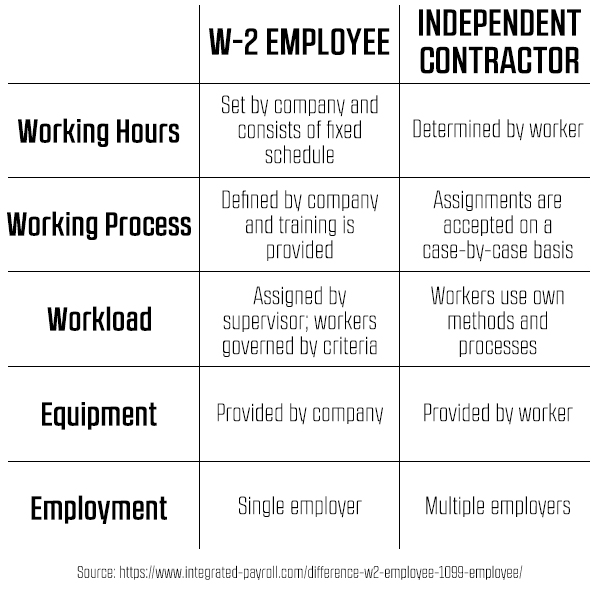

Overtime for 1099 Independent Contractors The matter of classification of employees as independent workers and not employees is a move by employers to seek tax benefits at the expense of employees By classifying employees as independent contractors, employees receive 1099 tax forms as opposed to W2's, tax forms used by employeesA 1099 contractor is not an employee of the business or businesses with which he works;1/4/21 A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the company

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

1

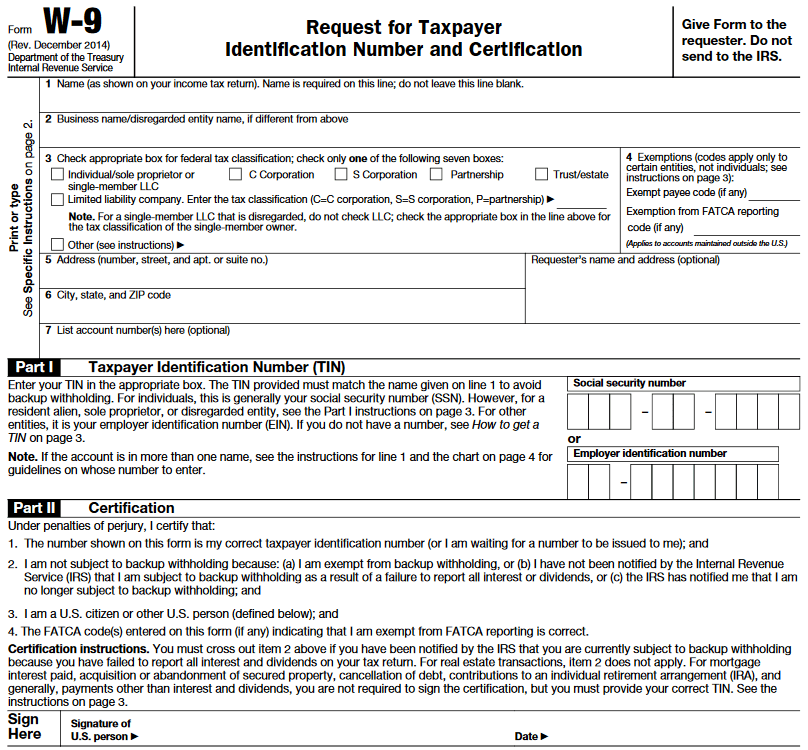

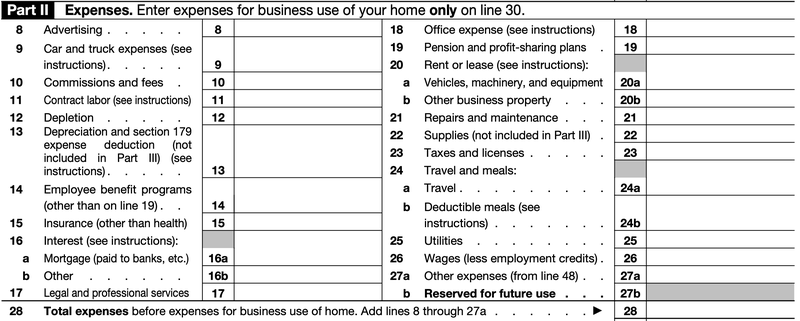

4/6/18 An independent contractor agreement is between a client and a company that makes a promise to produce services in exchange for paymentThe client will have no responsibility for employees, subcontractors, or personnel in connection with the services provided Their only obligation will be to pay the independent contractor with no liability if anyone should get injuredIndependent Contractors and the 1099 If an employer has paid an independent contractor more than $600 in payments related to the business, then the employer will need to fill out an IRS Form 1099MISC This form will provide an income summary of all the employer's compensation that is not employee relatedIt's another story for freelancers and independent contractors who have their income reported on Forms 1099 If you are earning Form 1099 income you need to know your income tax bracket because you do not have the benefit of employer withholding and must send estimated tax payments to the IRS each quarter

1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Vs W2 Difference Between Independent Contractors Employees

However, 1099 independent contractors can only go to court to settle their disputes and to enforce other rights under the contract agreement You Signed an Agreement as an Independent Contractor When starting a job, an employer may make you sign an agreement outlining that you are an independent contractor1099 Independent Contractor ← Back to Jobs SUPERIOR FREIGHT LOGISTICS INC Atlanta, GA FullTime Job Description Aimer ATL COMING SOON!8/7/ Workers who complete tasks or work on individual projects will fall under a 1099 An independent contractor is able to earn a living on his or her own rather than depending on an employer Independent contractors are often referred to as consultants, entrepreneurs, business owners, freelancers, or as selfemployed individuals

A 21 Guide To Taxes For Independent Contractors The Blueprint

What Is Independent Contractor Insurance Coterie Insurance

While a 1099 independent contractor CRNA work for themselves according to the schedule they desire to work They are paid for their time worked and pay their own taxes So, as you've likely figured out there are tax considerations when deciding which way to go as a CRNAAlliance1099org LLC Professional Society Helping 1099 Independent Contractors, Professionals Consultants & Entrepreneurs Navigate Difficult Events, Trends, Times, People & Issues to Achieve Their Goals!™ Why Join Professional Society Membership Professional Development Business Development Personal & Legacy Development Essential 1099 Business Services MasterMind1099 Form Independent Contractor Printable – A 1099 form reports certain kinds of income that tax payers have earned during the year A 1099 form is crucial because it's used to record nonemployment income earned by a taxpayer Whether it's cash dividends paid by a company that owns a stock or interest accrued from a bank account, a taxfree 1099 can be issued 1099 Form Independent

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

How To Pay Tax As An Independent Contractor Or Freelancer

We deal with two types of workers in this article the independent contractor (1099 worker) and the employee (W2 employee) Simply put, the W2 employee is a standard fulltime employee the employer pays them a regular wage or salary (on a weekly, biweekly, or monthly basis), withholds their income tax, pays their payroll taxes, health insurance, and provides other employee benefitsAs a 1099 independent contractor, all you need to do is make sure you have the proper licenses and permits for your business and simply start conducting business While there is paperwork involved with setting up the LLC, the LLC structure provides an independent contractor with personal liability protection The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)

1099 Tax Deductions What Every Independent Contractor Needs To Know

By 50 Of Americans Are Expected To Be Independent Contractors Freelancers Alexander S Blog

Overtime for 1099 Independent Contractors Independent contractors are not entitled to overtime pay However, some employers may misclassify you as an independent contractor, yet in reality, you are an employee In such a scenario, you will be entitled to overtime The primary role of Workers Compensation Attorney Law Firm is to ensure that For example, if you give a worker a 1099 Form rather than a W2 Form, they may still be an employee Persons who work for you may qualify as employees under the law, even if, for example You have the person sign a statement claiming to be an independent contractor;Meal and Rest Breaks for 1099 Independent Contractors Under California's labor laws, 1099 independent contractors do not have a right to meal and rest breaks These labor laws have caused many employers in Long Beach to misclassify their employees as independent contractors for them to avoid providing them with meal and rest breaks

1099 Misc Form Fillable Printable Download Free Instructions

1

Independent contractors are people who offer their professional services to clients They are usually selfemployed owners of small businesses that you hire for a fixed period of time or on a perproject basis Independent contractors may go by similar names such as 1099 contractors, freelancers or selfemployed workersJoin our email list29/5/ 1099 Independent Contractors Many small business owners attempt to legitimize their payroll tax avoidance schemes by paying employees via check and calling them 1099 Independent Contractors Whereby the business owner treats the worker as an employee but pays them via check with no payroll tax deductions When the end of the year arrives, the

Top 25 1099 Deductions For Independent Contractors

Do You Need A W 2 Employee Or A 1099 Contractor How To Start Grow And Scale A Private Practice Practice Of The Practice

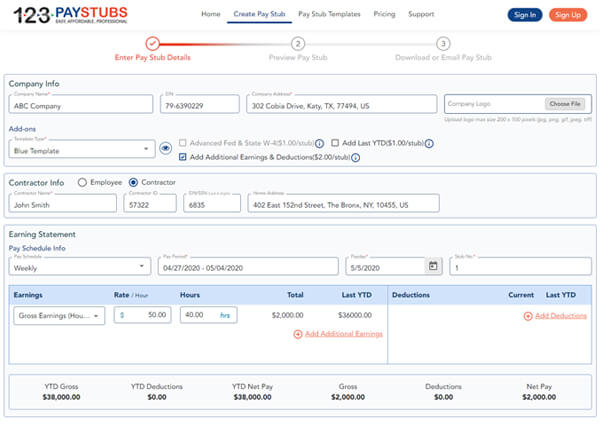

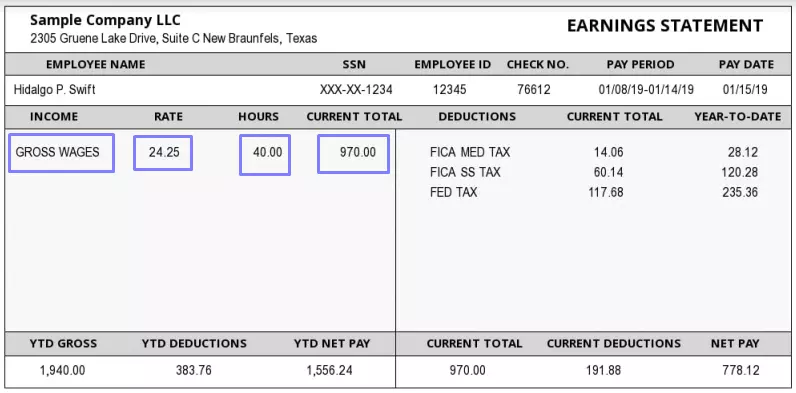

2/4/21 The 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors They can be easily generated through several online generators as long as the contractor has the right information to fill in the forms After generating them, the pay stubs can be printed and stored or sent to the necessary parties1/7/21 There may be unexpected expenses or accidents while running a business or even as an independent contractor Business insurance protects you from such losses, which is also a part of 1099 tax deductions Summary Being an independent contractor or selfemployed individual comes bearing a lot of freedom of work, job role and general flexibilityWhen managing temporary workers or independent contractors, don't risk legal trouble by trying to manage taxes and compliance on your own Let EWM do the heavy lifting and avoid worker misclassification and coemployment issues Reducing Risk Just

1099 Forms Everything Businesses Contractors Must Know To Be Stress Free About Taxes

W 9 Vs 1099 Understanding The Difference

30/8/21 Usually, 1099 independent contractors and W2 employees are two totally different tax classifications As an employer, you have fewer tax responsibilities for a 1099 independent contractor than a W2 employee Let's look at how workers are typically classified,11/3/21 As an independent contractor, you won't get a W2 with a tidy list of your income and deductions Instead, every client that paid you more than $600 is required to send you a 1099 contractor form12/2/ IRS Form 1099 MISC IRS 1099 MISC Form accumulates a person's income from all his / her nonemployee compensation The independent contractors use this Form 1099 to calculate and file their taxes When you are an employer, you must send the Form 1099MISC to all the contractors you have employed and paid them $ 600 or more during the tax year

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

1099 Misc Form Fillable Printable Download Free Instructions

Free Independent Contractor Agreement Pdf Word

Walk Through Filing Taxes As An Independent Contractor

W2 Employee Versus 1099 Independent Contractor Compliance Checklist Liquid

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

1099 Vs W2 How 4 Different Agencies View Independent Contractor Relationships Infographic Employers Resource

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

Advantages Of 1099 Contractors Hr Daily Advisor

Harsher Penalties Recommended For Employers Who Misclassify Employees As Independent Contractors

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

Form 1099 Definition

How To Become A 1099 Independent Contractor As A Physician Assistant Youtube

1099 Vs W2 Employee Which Is Better For Your Llc Business Fundsnet

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

3

Filing Taxes 1099 Forms Every Independent Contractor Should Know About Moves Financial

What S The Difference Between W 2 1099 And Corp To Corp Workers

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

Should You Choose 1099 Or W 2 Independent Contractor Tax Advisors

Employee Vs Independent Contractor What S The Difference

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

Independent Contractors Vs Employees Not As Simple As You Think New York Truckstop

1099 Misc Form Fillable Printable Download Free Instructions

Ready For The 1099 Nec

What Is A 1099 Employee The Definitive Guide To 1099 Status Supermoney

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

1

How To Pay Tax As An Independent Contractor Or Freelancer

The New Form 1099 Nec And 1099 Best Practices To Kickstart 21

Instant Form 1099 Generator Create 1099 Easily Form Pros

Who Are Independent Contractors And How Can I Get 1099s For Free

W2 Employee Or 1099 Independent Contractor A Quick Primer Employee Or Independent Contractor

Managing The Ubiquitous Form 1099 Payroll Management Inc

How To Approach Tax Season As A 1099 Employee Thepaystubs

A 21 Guide To Taxes For Independent Contractors The Blueprint

Who Should You Hire Independent Contractor Vs Employee Top Echelon

What Is An Independent Contractor 1099 Contractor

Independent Contractor 101 Bastian Accounting For Photographers

Llc Sole Proprietors And 1099 Independent Contractors Now Qualify For A Ppp Loan You Need To Learn About Owner Compensation Replacement The Best Words

Employee Vs Independent Contractor How Tax Reform Impacts Classification Tax Pro Center Intuit

Independent Contractor 101 Bastian Accounting For Photographers

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

How To File 1099 Misc For Independent Contractor

New Paychex Data Shows Independent Contractor Growth Outpaces Employee Hiring In Small Businesses

Before You 1099 Make Sure You W 9 Cpa Practice Advisor

Small Business Tax Preparation For Independent Contractors

New 1099 Nec Form For Independent Contractors The Dancing Accountant

A 21 Guide To Taxes For Independent Contractors The Blueprint

Independent Contractor Paystub 1099 Pay Stub For Contractors

Irs Launches New Form Replacing 1099 Misc For Contractors In Cpa Practice Advisor

Choosing 1099 Box Types 1099 Nec And 1099 Misc

Independent Contractors And Misclassification Forester Haynie

1099 Misc Instructions And How To File Square

Don T Miss The 1099 Misc Filing Deadline Adamsacctgkc Com

Where Is My 1099 Atbs

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

New Irs Rules For 1099 Independent Contractors

Should I Agree To Be Paid As An Independent Contractor

Irs Form 1099 Reporting Audit Proofing Your Business Lorman Education Services

How To File 1099 Misc For Independent Contractor

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

1099 Vs Employee Why The Difference Matters When You Hire A Caregiver Care Com Homepay

Independent Contractor 101 Bastian Accounting For Photographers

1099 Reasons To Hire Independent Contractors Ascend Business Advisory

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is A 1099 Contractor With Pictures

What Is A 1099 Vs W 2 Employee Napkin Finance

How To Pay Contractors And Freelancers Clockify Blog

Diligent Recordkeeping Key To Surviving Tax Time For Self Employed Taxpayers Hackensack New Jersey Self Employed Tax Lawyer Samuel C Berger Pc

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Apo Bookkeeping Consulting Services Home

Independent Contractor Pay Stub Template Fill Out Pdf Forms Online

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

Independent Contractor Cash Flow Planning For Life

Form 1099 Nec For Nonemployee Compensation H R Block

The Difference Between A W2 Employee And A 1099 Employee Ips Payroll

Employee Vs Independent Contractor Apollomd

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

Tax Changes For 1099 Independent Contractors Updated For

What Tax Forms Do I Need For An Independent Contractor Legal Io

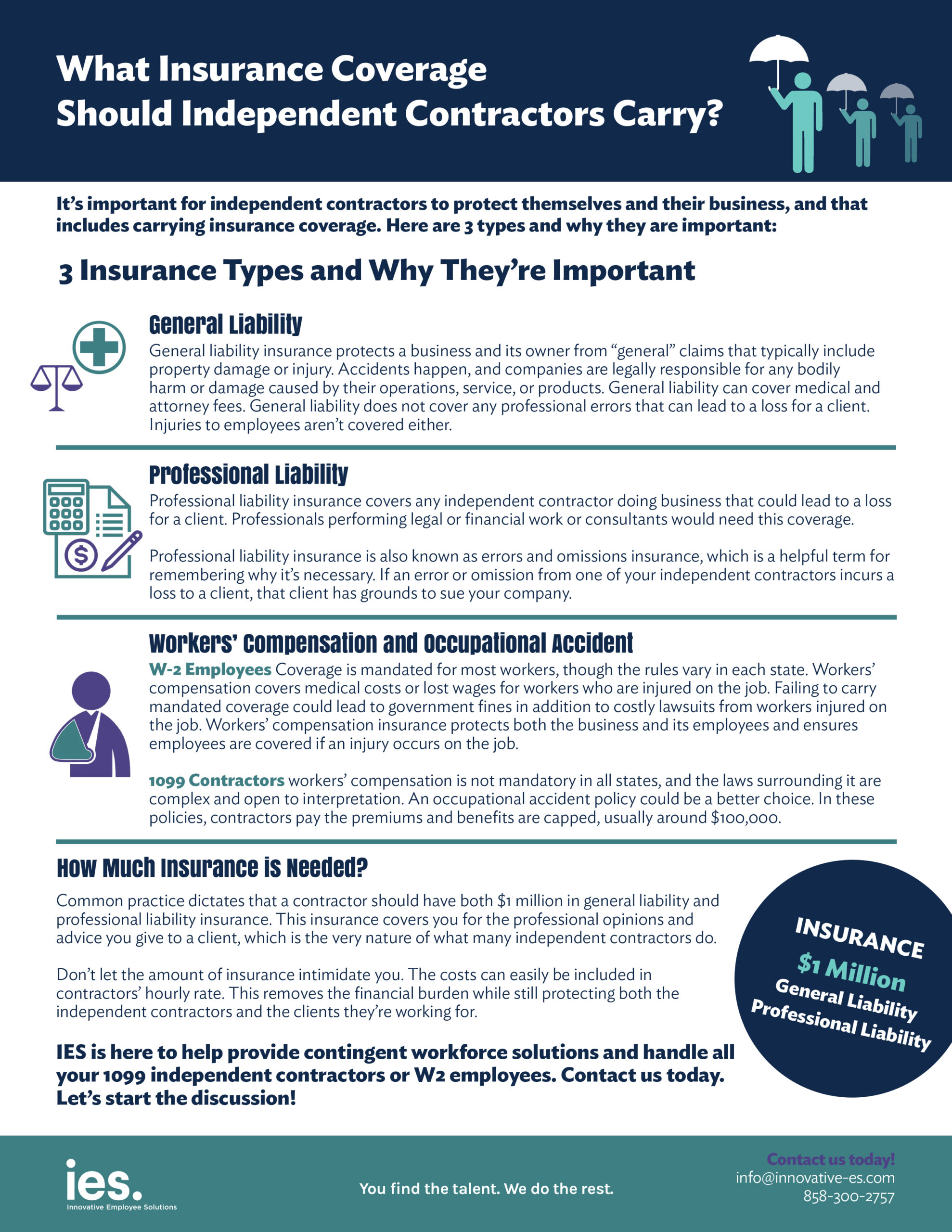

What Insurance Coverage Should Independent Contractors Carry

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting